Content

Hence, to increase an asset account, we debit it. To decrease an asset account, we credit. Revenue AccountRevenue accounts are those that report the business’s income and thus have credit balances.

A normal balance is the expectation that a particular type of account will have either a debit or a credit balance based on its classification within the chart of accounts. It is possible for an account expected to have a normal balance as a debit to actually have a credit balance, and vice versa, but these situations should be in the minority. The normal balance for each account type is noted in the following table. Nuncio Consulting completed the following transactions during June. Armand Nuncio, the owner, invested $35,000 cash along with office equipment valued at $11,000 in the new company in exchange for common stock. A $4,500 debit to Salaries Expense in a journal entry was incorrectly posted to the ledger as a $4,500 credit, leaving the Salaries Expense account with a $750 debit balance.

Record an Expense Purchased on Vendor Credit

An offsetting entry was recorded prior to the entry it was intended to offset. An entry reverses a transaction that was in a prior year, and which has already been zeroed out of the account.

What is a normal credit balance?

(Accounting: Financial statements) The normal balance of an account is the side of the account that is positive or increasing. The normal balance for asset and expense accounts is the debit side, while for income, equity, and liability accounts it is the credit side.

Pacioli devoted one section of his book to documenting and describing the double-entry bookkeeping system in use during the Renaissance by Venetian merchants, traders and bankers. This system is still the fundamental system in use by modern bookkeepers. Shares PremiumShare premium is the difference between the issue price and the par value of the stock and is also known as securities premium. The shares are said to be issued at a premium when the issue price of the share is greater than its face value or par value. This premium is then credited to the share premium account of the company. With routinely updated debit and credit details. As mentioned above, the following facts appear on the credit side.

Record a Customer Payment on a Previous Credit Sale

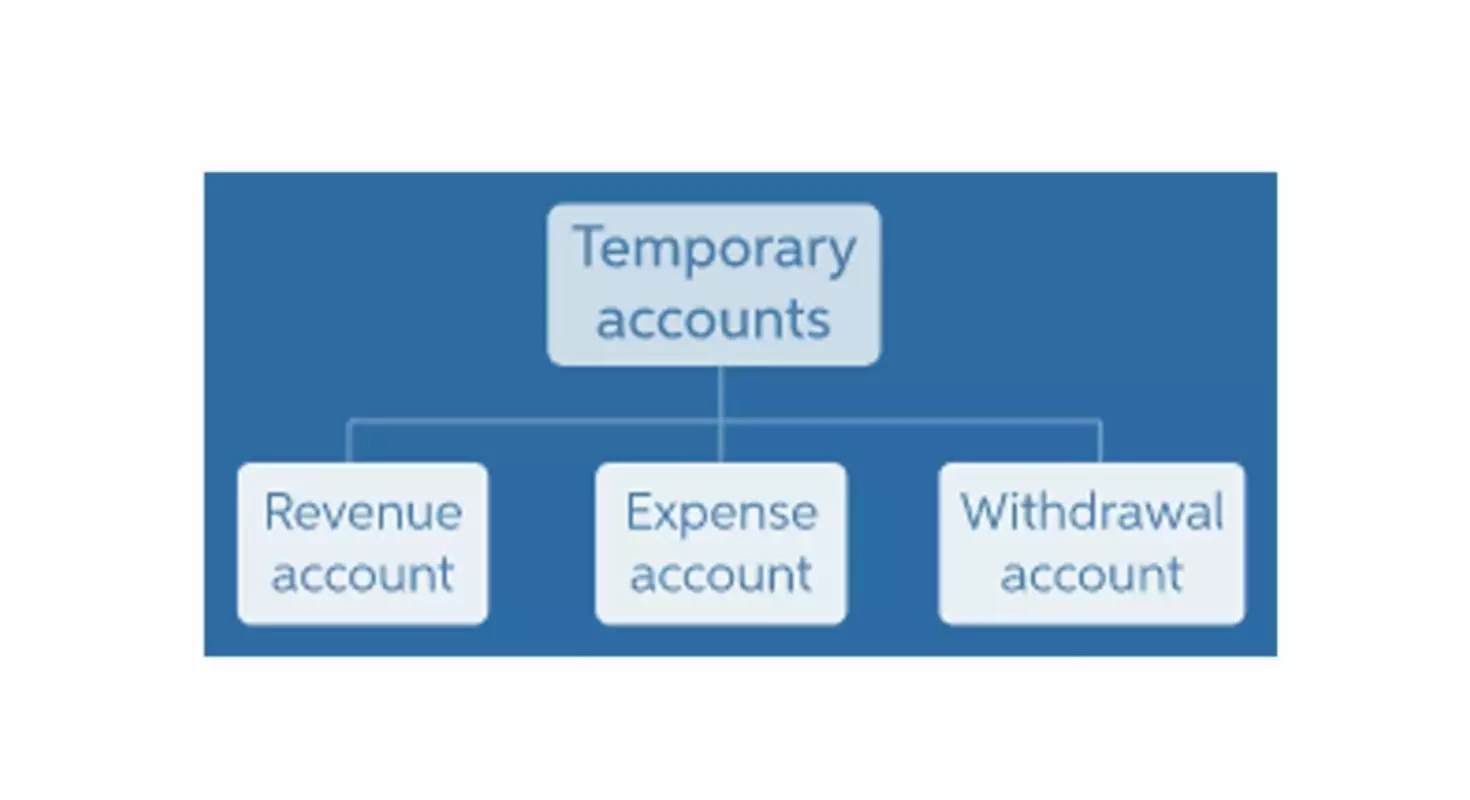

When a company earns money, it records revenue, which increases owners’ equity. Therefore, you must credit a revenue account to increase it, or it has a credit normal balance.

Examples are accumulated depreciation against equipment, and allowance for bad debts against accounts receivable. For example, sales returns and allowance and sales discounts are contra revenues with respect to sales, as the balance of each contra is the opposite of sales . To understand the actual value of sales, one must net the contras against sales, which gives rise to the term net sales . An account’s assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases. Therefore, asset, expense, and owner’s drawing accounts normally have debit balances. Liability, revenue, and owner’s capital accounts normally have credit balances.

Where Is The First Place Every Transaction Is Recorded?

Expenses are subsequently deducted from sales revenue to determine operating income. The process of using debits and credits creates a ledger format that resembles the letter “T”. The term “T-account” is accounting jargon for a “ledger account” and is often used when discussing bookkeeping. The reason that a ledger account is often referred to as a T-account is due to the way the account is physically drawn on paper (representing a “T”).

However, instead of normal balanceing the debit entry directly in the owner’s capital account, the debit entry will be recorded in the temporary income statement account Advertising Expense. Later, the debit balance in Advertising Expense will be transferred to the owner’s capital account. Since assets are on the left side of the accounting equation, both the Cash account and the Accounts Receivable account are expected to have debit balances. Therefore, the Cash account is increased with a debit entry of $2,000; and the Accounts Receivable account is decreased with a credit entry of $2,000.